Century Claims Management, Inc. is a family owned and operated Public Adjusting Firm, with over 40 years of experience in the claims industry throughout various states including Florida. We offer insurance claim adjusting and loss recovery services to maximize and expedite your claim.

3 Reasons to Hire a Public Adjuster

1. Potential for Higher Payout.

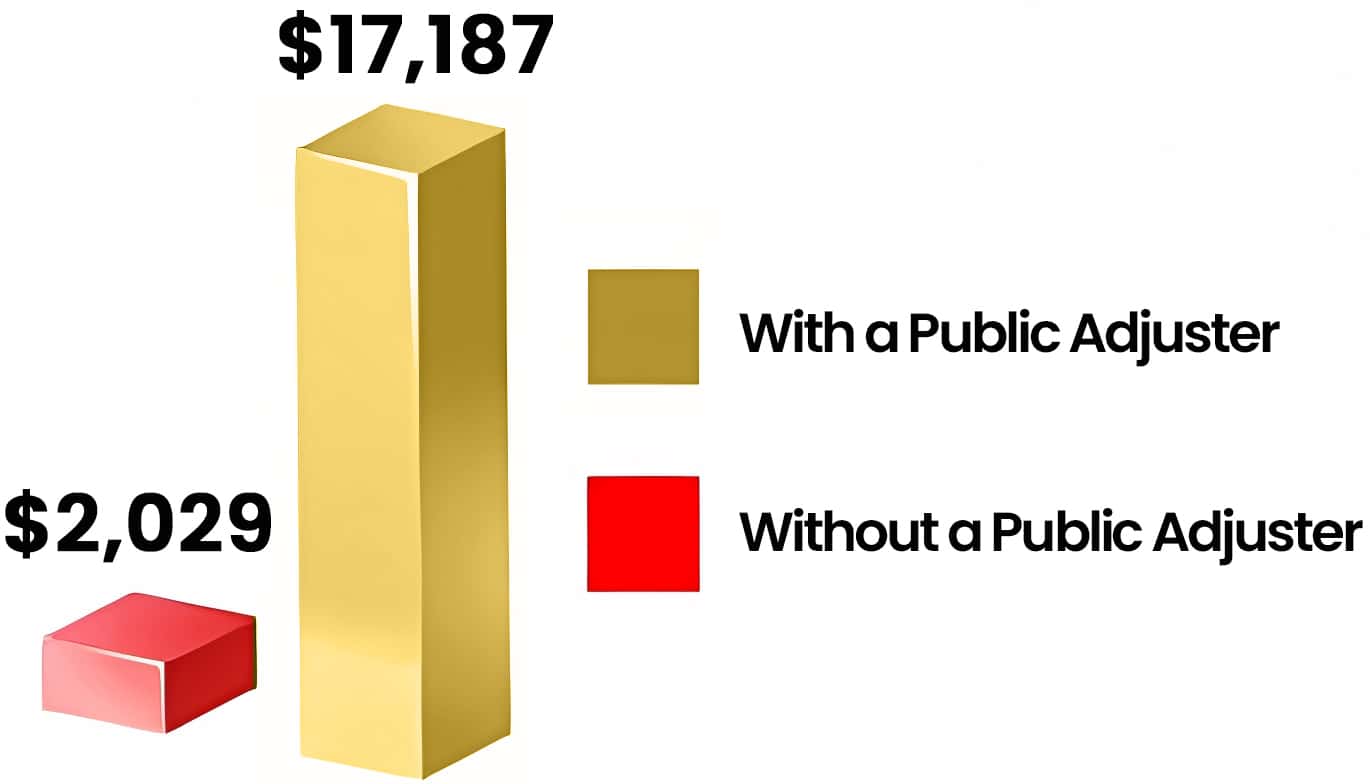

A recent report by the Office of Program Policy Analysis and Government Accountability proved that the use of a Public Insurance Adjuster WILL increase the final amount of the claim payments.

Public Adjusters exist because of the conflict of interest that exists when an entity (your insurance company) attempts to represent both sides of a financial transaction. There are no upfront costs. A Public Adjuster doesn’t get paid until you get paid and we will manage the process through completion to expedite and maximize your claim.

2. Understanding Insurance Policy

Public Adjusters are better equipped than the average policyholder to estimate the costs incurred from a property loss and local work rates.

This leads to higher and more accurate settlements. Public Adjusters commonly have prior experience in construction or other related fields, and we use software, and claims handling practices to undergo an independent evaluation of a client’s property loss.

3. Alleviate Stress

The process of evaluating, completing, and submitting a claim as a policyholder is remarkably time-intensive and complicated.

Going through a property loss at home or business is a stressful time. It’s a time when you should be focused on getting your home, business, and family back on a solid ground rather than feeling the pressure of learning the in’s and out’s of the insurance claims business. Truthfully people will regularly settle for less than the total cost of their damages because they are exhausted. Let us take the pain out of handling a claim.

Public Adjuster Representation Typically Results in Larger Payments

Source: OPPAGA analysis. Data refers to the median (50th percentile or typical) payment.

We work to get you the MAXIMUM.

Call our team today.

Schedule a Free

Claim Evaluation

Fill out the form below and we’ll get back to you as soon as possible.